Medicare Counseling

Our Health Insurance Counseling & Advocacy Program (HICAP) provides no-cost counseling, information, and assistance to consumers regarding the Medicare program.

Our counselors must complete intensive training and are registered with the California Department of Aging. They receive continuing education to remain aware of changes in Medicare regulations.

We can assist you with the following:

- Medicare benefits

- Supplemental (Medigap) insurance

- Medicare Advantage (MA) options

- Evaluate and identify the right Part D Drug plan

- Billing and claims procedures

- Assist on your behalf with providers

- Research Patient Assistant Programs (help with medication costs)

- Provide public speakers on Medicare-related issues

- Need help with your current Medicare coverage? Free Medicare Counseling Locations Click Here

We do not sell insurance; we provide unbiased information to help you make an educated decision about your health care coverage.

“This website was supported by the Administration for Community Living (ACL), U.S. Department of Health and Human Services (HHS) as part of a financial assistance award totaling $76,917.00 with 100 percent funding by ACL/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by ACL/HHS, or the U.S Government.”

For any questions, please call HICAP (Health Insurance Counseling and Advocacy Program) at 1-800-434-0222

Contact Us

HICAP Manager

HICAP Specialist

HICAP Assistant

HICAP Counselor

Programs Director

Are Medicare prescription drugs costing you too much?-Reduce or eliminate monthly premiums for your Prescription Drug Plan – Eliminate your drug deductible.

Check to see if you qualify.

Monthly income at or below:

$1,903/single

$2,576/couple

Savings at or below:

$17,220/single

$34,360/couple

If you qualify, give us a call: 1-800-434-0222

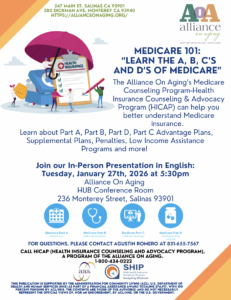

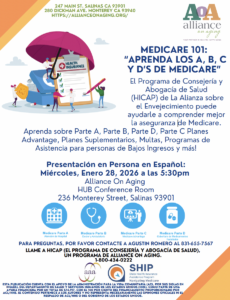

Medicare 101:

“Learn the A, B, C’s and D’s of Medicare”

Part A, Part B, Part D, Part C Advantage Plans, Supplemental Plans, Penalties, Low Income Assistance Programs and more!

Follow these 3 tips to protect yourself from scammers.

- If you get a call, text or email asking for your Medicare Number, don’t respond. Don’t give your Medicare card or Medicare Number to anyone except your doctor or people you know should have it. Remember, Medicare will never call you unprompted and ask you for your personal information.

- Check your Medicare Summary Notices (MSNs) or claims statements carefully. If you see a charge for a service you didn’t get or a product you didn’t order (like a COVID-19 over-the-counter test), it may be fraud.

- Monterey HICAP also serve as Senior Medicare Patrol Liaisons and assists Medicare beneficiaries with the prevention, detection, and reporting of Medicare fraud.

- To report a Medicare Fraud, please contact Senior Medicare Patrol (SMP) toll-free hotline 1-855-613-7080.